The Four Pillars Shaping the Future of Risk Management

In the dynamic landscape of risk management, where the stakes are high and the adversaries ever evolving, the role of risk executives and their teams has never been more critical. Financial crimes compliance, a linchpin in the risk management ecosystem, demands not only vigilance but also a proactive approach towards innovation. In this pursuit, four key factors stand out as the driving forces propelling risk leaders into the future: Revenue, Cost, Ethics, and Regulation.

Revenue: Beyond Profit, Toward Resilience

Revenue, the lifeblood of any organization, plays a pivotal role in shaping financial crimes compliance programs. Risk leaders must view compliance not merely as a cost center but as an investment in resilience. Retention, growth, and attrition are not just metrics for financial success; they are also indicators of the robustness of an organization’s risk management strategy. By aligning compliance efforts with revenue goals, risk leaders can create a symbiotic relationship between financial health and crime prevention. Key elements of the program must focus on how rapidly can we onboard new customers or new business. Understanding who doesn’t present a risk to business an liberate the organization to follow those opportunities.

Cost: Balancing People, Technology, and Opportunity

The cost of compliance is a perpetual concern, but it is also a realm ripe for innovation. People, the heartbeat of any organization, need to be equipped with the right skills and knowledge. Technology, a powerful ally, can automate mundane tasks, enhance analysis, and provide real-time insights. The often-overlooked opportunity cost should be a conscious consideration—what could the organization achieve if resources were redirected from compliance maintenance to strategic initiatives? By striking a balance between these elements, risk leaders can redefine cost from an obstacle to an enabler of innovation. The regulatory priorities have created a plethora of areas that a risk professional must be an expert in, that is now only humanly possible for a select few on the planet. The option of Precise Lanaguage Models enable distributed intelligence from experts through public private partnership to guide every risk individual in the organization. Precise Lanaguage Models can understand the complexities of Human, Drug, Wildlife and Weapons trafficking and identify possible risks that can be routed to the appropriate business and risk analyst.

Ethics: The Moral Imperative

Financial crimes have a profound impact on society, making ethics an inherent aspect of risk management. Collaboration with law enforcement and NGOs not only strengthens the ethical fabric of an organization but also amplifies its impact beyond financial considerations. Risk leaders must embed ethical considerations into the DNA of their compliance programs. By doing so, they not only fulfill a moral imperative but also enhance their organization’s reputation as a responsible corporate citizen. Ethical AI is key to that decision making process, providing the ability to look at all customers, partners and suppliers to ensure the reputation and business of an enterprise is protected at scale 24x7x365, keeping up with global developments as they occur.

Regulation: Navigating the Compliance Maze

The regulatory landscape, governed by entities such as FinCEN, OCC, FINRA, FDIC, Fed, and SEC, is a complex web that risk leaders must navigate. Rather than viewing regulations as constraints, astute risk executives see them as guideposts for innovation. Compliance programs should not merely check boxes; they should align with the spirit of regulations while anticipating future changes. By embracing regulatory compliance as a driver of innovation, risk leaders can stay ahead of the curve, turning compliance challenges into opportunities for organizational growth.

In the crucible of financial crimes compliance, risk leaders find themselves at the intersection of these four influential factors. Success lies in recognizing the interconnectedness of revenue, cost, ethics, and regulation, and leveraging them to propel compliance programs into the future. The journey toward innovation requires a mindset shift—from viewing compliance as a burden to understanding it as a strategic asset.

As risk executives embark on this transformative journey, they must remember that the true measure of success is not only in preventing financial crimes but in fostering a culture of resilience, responsibility, and continuous improvement. The future of financial crimes compliance belongs to those who dare to innovate, who see challenges not as obstacles but as opportunities to reshape the narrative of risk management. It’s time to embrace these four pillars, for in doing so, they not only safeguard their organizations but also become architects of a safer, more secure financial landscape.

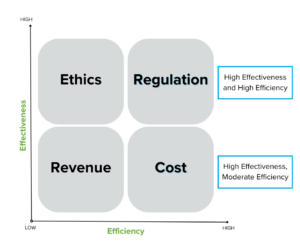

Innovation in Risk Quadrant:

- Revenue:

- Efficiency: Revenue-driven efficiency involves optimizing processes to ensure that compliance efforts do not impede revenue generation. This could include streamlined customer onboarding processes and efficient transaction monitoring.

- Effectiveness: The effectiveness of revenue-driven compliance is in its ability to not only prevent financial crimes but also contribute positively to business growth. It ensures that compliance efforts align with revenue goals.

- Cost:

- Efficiency: Cost efficiency focuses on optimizing the use of resources, both human and technological, to maintain compliance. Automation, smart resource allocation, and streamlined workflows contribute to cost efficiency.

- Effectiveness: The effectiveness of cost-driven compliance lies in achieving robust risk management without unnecessary expenditure. It involves balancing the cost of compliance with the value it adds to the organization.

- Ethics:

- Efficiency: Ethical efficiency involves incorporating ethical considerations seamlessly into compliance processes. It means that ethical principles are not just upheld but integrated in a way that enhances the overall efficiency of the compliance program.

- Effectiveness: The effectiveness of ethical compliance is measured by the positive impact on the organization’s reputation, stakeholder trust, and societal contribution. It goes beyond mere adherence to rules, aiming for a higher standard of conduct.

- Regulation:

- Efficiency: Regulatory efficiency focuses on meeting compliance requirements in a streamlined manner. It involves staying ahead of regulatory changes, leveraging technology for compliance monitoring, and minimizing the administrative burden.

- Effectiveness: The effectiveness of regulatory compliance is in its ability to not only meet current regulatory standards but also anticipate and adapt to future changes. It ensures that compliance efforts are proactive and future-proof.

Leave us a comment with your perspective. If you are interested in learning how Quantifind can help you select the best risk intelligence solution based on these four pillars, please email us at contact@quantifind.com.