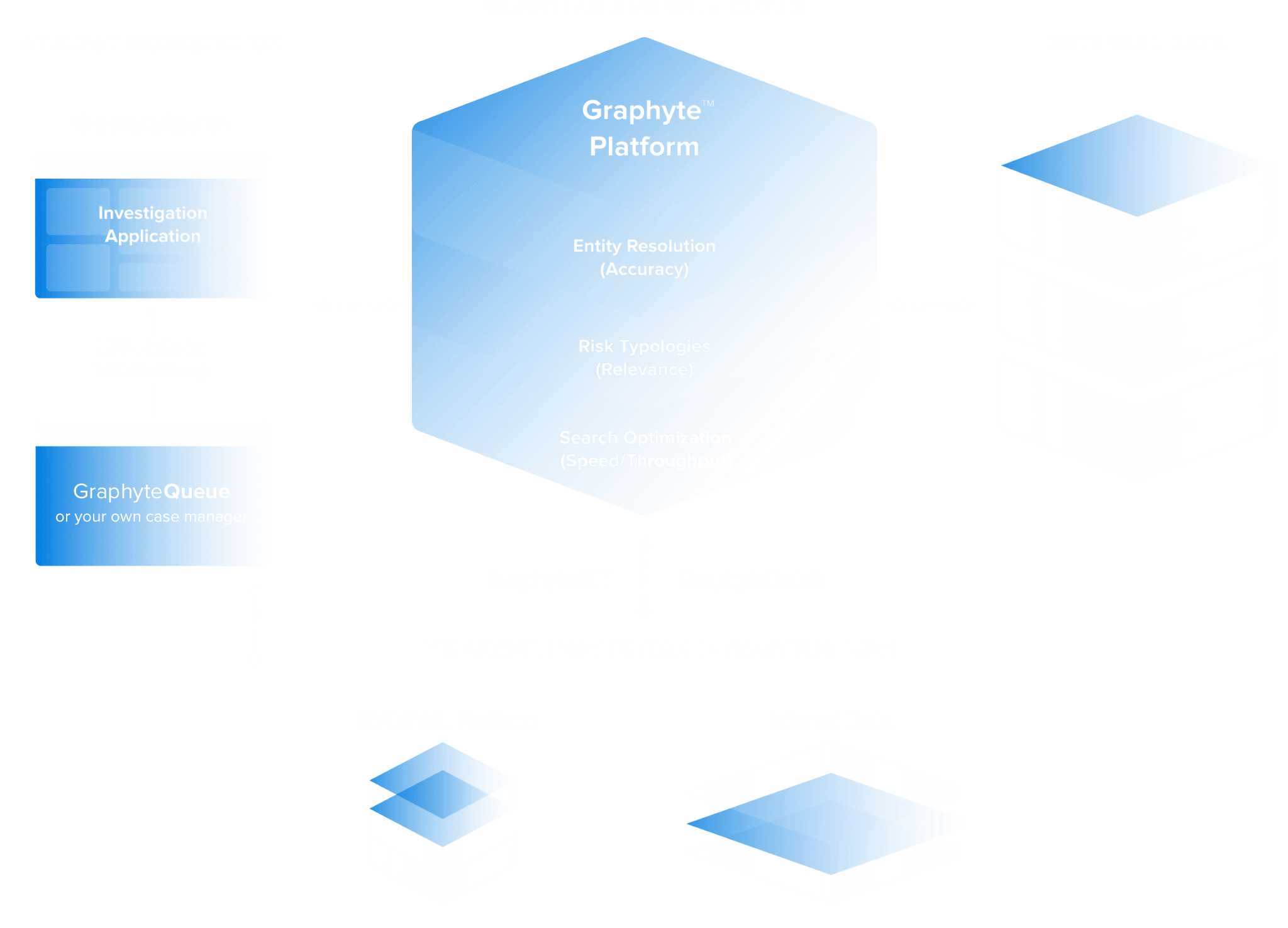

The Graphyte Platform

Intelligent Financial Crimes Automation

Graphyte lets you capture the full value of external data towards making KYC-AML initiatives more productive and effective.

Comprehensive data coverage

AI-driven entity resolution

Dynamic risk typologies

Patented search optimization

Modern investigation applications

Graphyte is different.

Comprehensive data coverage, AI-driven entity resolution accuracy, dynamic risk typologies, patented search optimization techniques, modern and intuitive investigation applications. Graphyte puts all of this technology at the fingertips of all of your KYC-AML teams from a single pure-SaaS platform.

Fast, accurate risk assessments let you zero-in on real risks.

FOCUS ON RISK

Better science

Graphyte users are seeing dramatic improvements in the productivity and effectiveness of their investigations teams

Higher accuracy

AI-powered entity resolution and risk models yield higher name matching and risk assessment accuracy than alternative solutions.

Modern tools

Graphyte includes powerful APIs and a modern, intuitive investigation application, with detailed results and automated reporting about a subject and related entities.

Relevant data

External data sources include global English and non-English news, sanctions & PEP lists, official and non-standard lists of known criminals, company data, and leaks databases, plus programmatic search.

Massive Operational

Efficiency Gains

Gain efficiencies throughout the AML-KYC workflow; monitoring, search, curation, review, and reporting

Pre-built integrations with leading case management platforms mean that the benefits of automation can be incorporated quickly and without disturbing established processes

Risk assessments are retrieved either through a web-based user interface, synchronous or batch APIs, and through integrations with your case manager

Data sources are comprehensive, and all search results, analysis, and reporting is performed in a single investigation interface

Superior Screening and Investigations Performance

10-100x accuracy superiority enables discovery of entities twice as likely to be named in a SAR/STR

The distractions of irrelevant, inaccurate results are avoided, and risk-rankings let you prioritize the highest risk cases

Leverage natural language processing, contextualization, and patented database technologies

Avoid the pitfalls of searching machine-translated content with transliterated queries

Graphyte Search

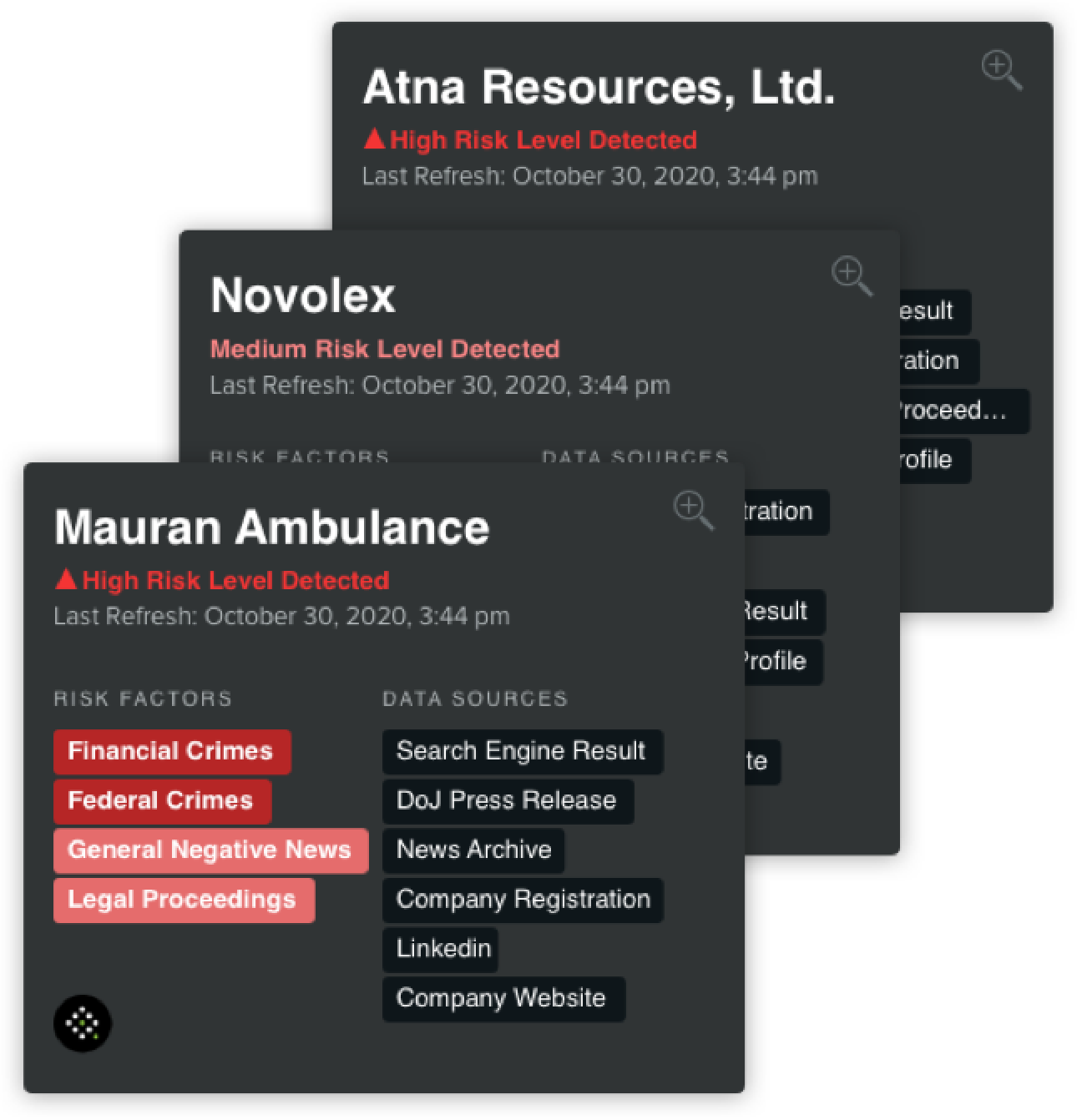

THE MOST ADVANCED INVESTIGATION APPLICATION

GraphyteSearch is a modern web-based investigation application, with a consumer-grade user experience, rich feature set, intuitive workflows, and automated reporting.

FEATURES

Expand your search in one click

Automatically scan across a broad range of public and online data including online news sources, company registration data, and leaks databases.

Know your customers’ customers

Seed a query with as little information as a name or email address to discover risk factors on transaction counterparties and other non-customers.

Assess risk in relationships

Reveal the entities related to a known individual or business that are surfaced from across the external data and rank-ordered for risk and relevancy.

Verify beneficial ownership

Proactively conduct your own verification of Ultimate Beneficial Ownership (UBO) when risk exposure is high, anchoring on verified public data.

Automate reporting

Improve consistency and save time with automated report generation that covers all of your findings.

Work in your familiar environment

Seamless case manager integrations make results available in case manager, with deep links to full search.

Graphyte Queue

YOUR AI-NATIVE CASE ACCELERATOR

GraphyteQueue is a modern, AI-native case manager purpose-built for name and transaction screening, designed to cut review time in half while improving accuracy and auditability.

FEATURES

Roll up related alerts

Automatically consolidate duplicate or connected alerts into a single, reviewable case with complete context from the start.

Summarize risk instantly

Leverage our native AI capabilities to generate concise, explainable narratives that surface the key risk insights for faster decision-making.

Decide in bulk

Apply a single disposition across multiple related events or an entire case to reduce clicks and ensure consistent outcomes.

Route work intelligently

Assign cases automatically by role, expertise, or risk priority to keep analysts focused and handoffs seamless.

Track everything for audits

Maintain full transparency with action logs, dashboards, and audit-ready reporting to demonstrate compliance at any time.

Integrate with your workflows

Export outcomes or escalate directly into enterprise case managers, or use GraphyteQueue as a standalone workspace.

Graphyte API

Integrations via REST APIs let investigators stay anchored in one platform with access to all the data needed to conduct a true 360° risk assessment.

- On-demand link-out to the GraphyteSearch Application

- Synchronous risk assessments accessible in the case manager

Graphyte Batch API

GraphyteBatch API provides the ability to submit large numbers of queries at once. These queries can be used to prioritize cases by risk, such as to clear a backlog.

- Risk assessments are generated automatically, allowing API-driven implementations that sort, filter, and prioritize applications and alerts backlogs.

- Prepopulated risk assessments for all case subjects, driven by overnight batch processing

Make an impact across the board.

COMPLETE AND COHESIVE

Graphyte makes risk screening and investigations more impactful throughout your organization, from customer onboarding and screening to continuous monitoring to investigations and SAR submission.

Watchlist Screening

Graphyte’s comprehensive list coverage, real-time search, and AI-powered entity resolution deliver accurate results on up-to-date information with significantly reduced false positives.

Adverse Media Screening

Graphyte’s accuracy and scalability lets you perform truly continuous monitoring across your customer base without a massive team of analysts investigating low-risk customers

Investigations

Automation using Graphyte enables 40% productivity gains and process consistency, thanks to comprehensive external data, best-in-class risk assessment accuracy, and modern investigation tools

Credit Risk

Graphyte enables continuous monitoring of real-time data that provides early, predictive warnings of financial stress and crime.

Comprehensive data coverage

Deep archive of global online news, including foreign language

Programmatic search engines

Public and private company corporate profiles Legal entity registrations (130+ jurisdictions worldwide) Federal law enforcement news: US DoJ, CAN RCMP, etc.

Financial regulatory statements: US SEC, UK FCA, HK SFA, etc.

Global sanctions and blacklists

Global politically exposed persons (PEP) lists

Offshore leaks databases including Panama Papers

Online public personally identifying information